How it Works

Your financial comfort matters to us, which is why we’ve designed a simple, smart process that helps you move forward with a quick personal loan without stress.

Quick Loan

Apply within minutes through our online loan application and access funds instantly whenever needed. Enjoy a seamless experience, whether you want a quick personal loan or a short-term personal loan.

Fast Approval

Skip long approvals and heavy paperwork. Our digital system evaluates your loan eligibility quickly, ensuring a smooth, secure, and hassle-free process for anyone seeking an instant personal loan online or an NBFC personal loan.

Direct Fund Transfer

Receive money directly in your bank account with quick, protected disbursal. Ideal for anyone needing instant cash loan support or an emergency personal loan assistance without dealing with delays or complexities.

Find the Right Loan for You

Why Choose BrightLoans?

When life gets unpredictable, you need dependable financial support that works fast. BrightLoans is built to deliver speed, safety, and simplicity for every borrower. From instant personal loan online approvals to secure disbursals, every step is crafted with your convenience in mind. Our transparent terms ensure no surprises, while flexible repayment plans help you stay in control.

Whether it’s a short-term personal loan, an emergency personal loan, or an instant cash loan, we deliver solutions that match your needs. With digital processes, minimal paperwork, and reliable customer support, BrightLoans ensures help arrives exactly when you need it the most.

Calculate Your Monthly Payments with Our Personal Loan EMI Calculator

Use the slider to adjust your interest rate and repayment period to instantly view a clear summary generated through our personal loan calculator.

Principal Amount

₹94,500

Interest Amount

₹34,965

Total Payable

₹1,29,465

Our Lending Partners

Powering instant loans with just a few clicks!

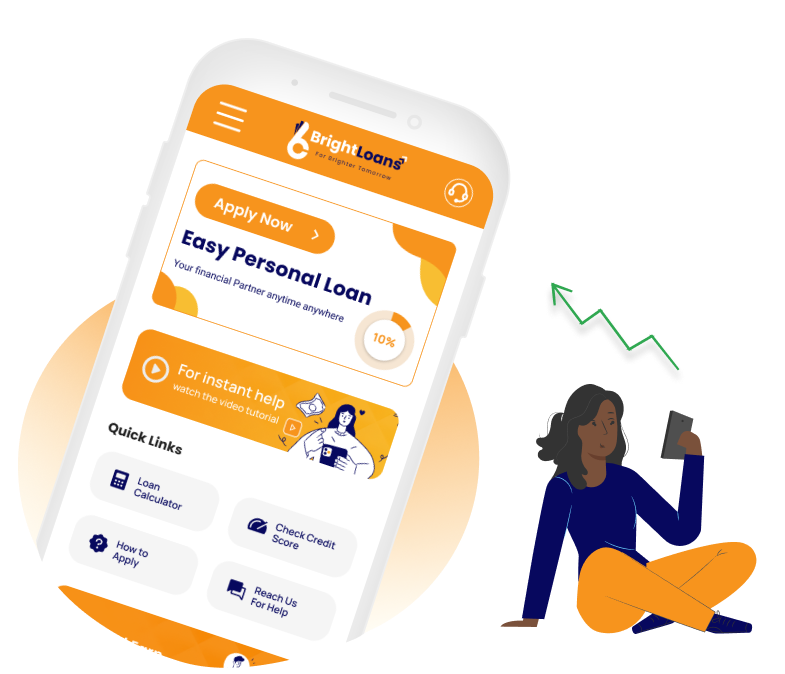

BrightLoans makes borrowing simple

fast, secure, and paperless.

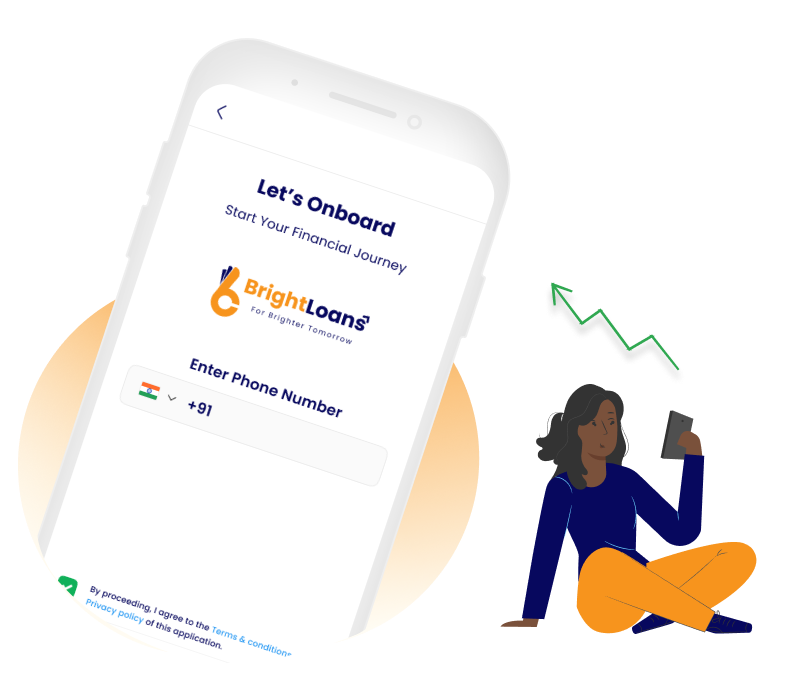

Apply Online in Minutes

Complete a short application from your phone or computer. No paperwork, no queues — just a smooth start to your loan journey.

Instant Decisions

Our system reviews your request quickly and shares the approval status within minutes, so you don’t waste time waiting.

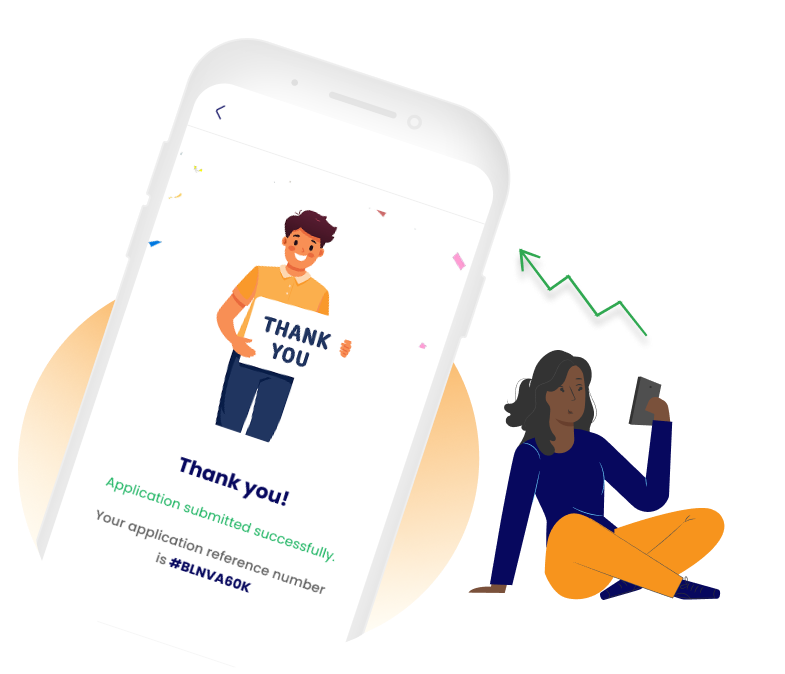

Fast Money Transfer

Once approved, your loan is credited straight into your bank account — ready to use for any urgent or planned need.

Smart Payment Alerts

We’ll remind you gently before each due date, helping you stay on track with repayments.

Transparent Terms

No surprises, no fine print. The repayment amount shown at the time of approval is exactly what you’ll pay.

Data protection you can trust

Your personal and financial details are kept safe with advanced security measures, so you can borrow with peace of mind.

Your Needs, Our Responsibility

Dedicated to helping you meet your financial goals with clear and simple lending.

Transparent Terms

Clear and simple loan terms without hidden charges, allowing you to borrow confidently and understand every detail before proceeding with your instant personal loan or quick personal loan selection.

Data Security

Your information stays protected through advanced systems, ensuring complete privacy during your online loan application and every stage of your NBFC personal loan journey.

Ongoing Supports

Our assistance continues even after your loan is disbursed, guiding you through repayment while helping you manage EMIs smoothly with personalised help whenever needed for your fast personal loan experience.

Frequently Asked Questions (FAQs)

No, BrightLoans offers instant personal loans without documents with minimal requirements, making the process simple, quick, and reliable for all eligible applicants seeking fast access.

Eligibility depends on income, credit behaviour, and repayment capacity, ensuring safer lending for applicants seeking NBFC personal loans or instant personal loan solutions.

Yes, self-employed applicants can easily access NBFC personal loan options through our online loan application process, allowing faster approvals tailored to business or personal requirements.

Your information stays protected with advanced encryption, offering complete safety for anyone applying for an instant cash loan or fast personal loan online.

It helps estimate EMIs, interest costs, and repayment schedules, assisting borrowers in selecting a low-interest personal loan plan that matches their financial comfort.

Yes, our quick loan online system ensures instant personal loan access during medical, home, or travel emergencies requiring immediate financial support.

Borrowers enjoy flexible EMIs and adjustable tenures, making repayment simple for those choosing short-term personal loans or longer EMI-based borrowing solutions.

Many users prefer BrightLoans as their best loan app due to fast approvals, transparent terms, and smooth digital processes for instant personal loan online access.

Approved amounts are transferred directly to your bank account, ensuring instant cash loan support for urgent needs without unnecessary delays or complications.