To Create / Login an Account

Short Term Loan

A short-term loan is a swiftly disbursed financial option designed for urgent needs. It involves a brief repayment period, requiring weekly or monthly instalments. These loans offer a lifeline during extreme emergencies, providing rapid access to funds.

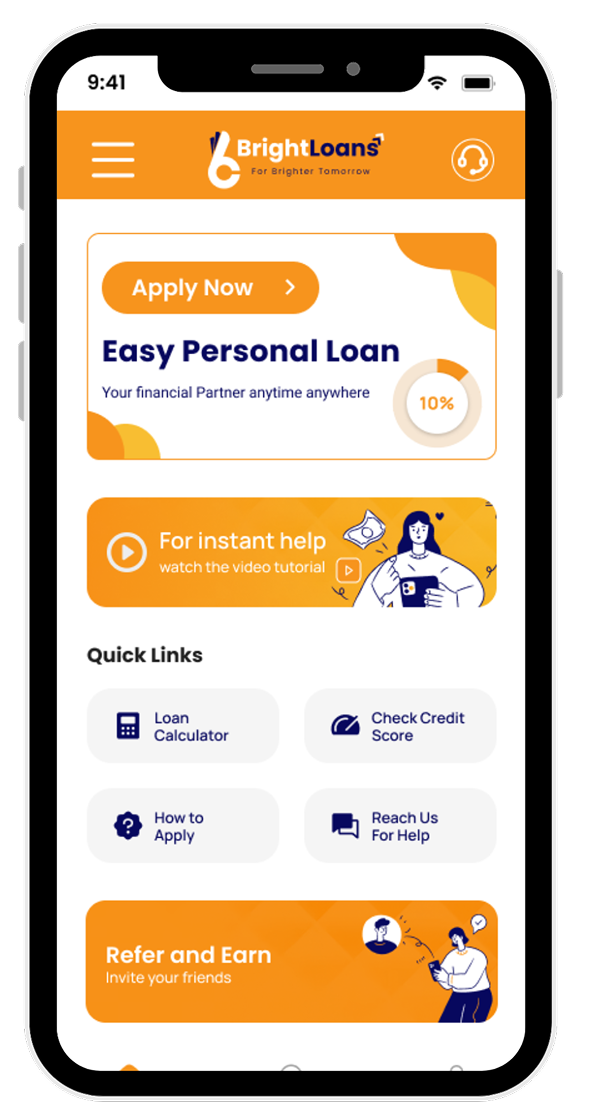

Personal Loan

A personal loan is a versatile financial solution tailored to alleviate unplanned expenses. It offers fixed rates, and regular monthly payments, and doesn't require collateral, making it an accessible choice for various situations.

Benefits

INSTANT FINANCIAL ASSISTANCE

We're here with a secure online platform to quickly provide funds for emergencies. Your eligibility is based on creditworthiness, and no collateral is needed. Our salary advance loans help when you lack cash backup for unexpected expenses or losses.

EASY FAST REDRESSAL

Say goodbye to lengthy paperwork and waiting in long queues. With our streamlined digital process, submit the required documents for approval. Within 30 minutes, your loan is approved and transferred to your bank account.

Flexible

We're here to assist you with multiple unforeseen expenses simultaneously – be it home repairs, medical bills, housing, utilities, weddings, or family emergencies. Our user-friendly application process comes with no upfront fees or charges, ensuring a straightforward experience.

RISKS

RELATIVELY HIGH INTEREST RATE

Interest rates are relatively elevated when compared to extended-term loans such as vehicle loans from banks.

RESIDENTS ONLY

Our services are exclusively available to Indian citizens.

SALARY-BASED LOANS

This is a brief loan service designated solely for employed individuals with a monthly income surpassing INR 30,000/-.

Terms and Conditions

By clicking "I agree" or "I accept," or by downloading, installing, or using the services, you are indicating your agreement to the terms and conditions outlined in this document. If you do not agree to these terms and conditions, please refrain from clicking "I agree", downloading, installing, or using the services. This is a legally binding agreement between AVINASH CAPITAL MARKETS PRIVATE LIMITED and yourself.

Read More...Loan Eligibility Criteria

Should be an Indian resident

Salaried Employee

Need to be Savings Bank Account Holder

Above 25 years of age is mandatory

Should have required documents

Documents Required

Your personal loan application should be completely filled with your current photograph

PAN Card is required

Residence proof – Driving Licence, Voter ID, Passport, Utility Bills (Electricity/Water/Gas), Post-paid/Landline Bill

Last 3 months' bank statements of the salary account

Last 3 months' Salary Slips

Rates and Fees

Monthly Interest Rate

2.9166

Offered Annual Percentage Rate (APR)

35% (Fixed)

Tenure/Repayment Period

1 - 3 Years

Minimum-Maximum Loan Amount

INR 10,000- 5,00,000

Processing Fee

2%

GST on Processing Fee (Exclusive)

18%

Representative Example

| Loan Amount | APR | Tenure | Processing Fee | GST on Processing Fee | Amount Disbursed | EMI | Total Repayment Amount | Total Interest |

|---|---|---|---|---|---|---|---|---|

| ₹ 50,000 | 35% | 12 Months | ₹ 1,000 | ₹ 180 | ₹ 48,820 | ₹ 4,998 | ₹ 59,978 | ₹ 9,978 |

Company Accreditation

We are registered under the name AVINASH CAPITAL MARKETS PRIVATE LIMITED, a registered NBFC (non-banking financial institution), approved by RBI.

Address & Accreditation

Completed Application Form

Please fill in all details accurately. Faster and precise completion will provide quicker fund disbursement. Apply now for swift financial support!

Passport-Size Photograph

Your A-4 size clear and extant passport photograph on a white background is required!

Identity (ID) Proof

Aadhaar Card and PAN Card are mandatory!

Address Proof

You can use any of these as proof of residence: Voter ID, Driver's License, Passport, Post-paid/Landline Bill, Utility Bill (Electricity/Water/Gas). Confirm your address with these documents.

Income Proof

We require your recent 3 months' bank statement (salaried account) and the past three months' salary slips. These documents are essential.